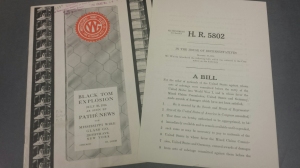

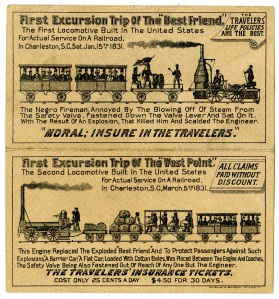

This little card was distributed as an advertisement for accident insurance from the Travelers Insurance Company. There is an 1888 calendar on one side with information on the cost to professional and business men. The other side contains two images of steam-powered locomotives, the Best Friend, and the West Point, with a cautionary tale about why one should purchase accident insurance when the travel. Text at the bottom indicates the printer of the card: The Kellogg & Bulkeley Co. HTFD, CT.

*click on images to zoom in

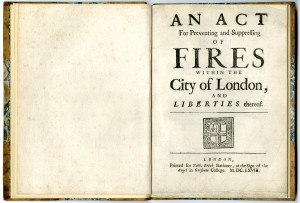

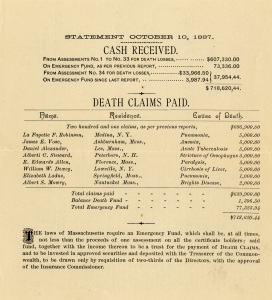

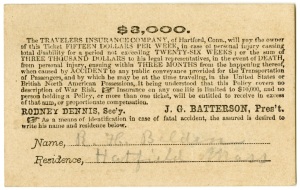

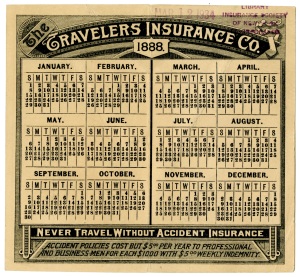

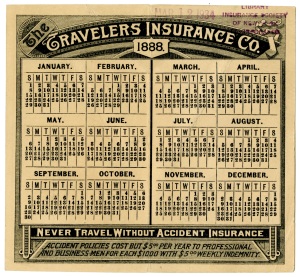

The Travelers Insurance Co.

The Travelers Insurance Co.

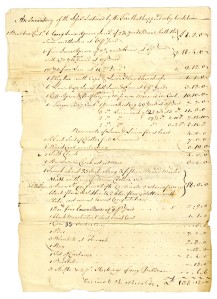

1888

Never Travel Without Accident Insurance

Accident Policies Cost But $5.00 Per Year To Professional

And Business Men For Each $1000 With $5.00 Weekly Indemnity

TOP

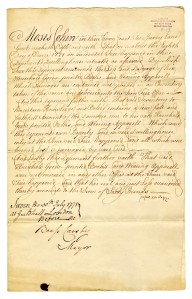

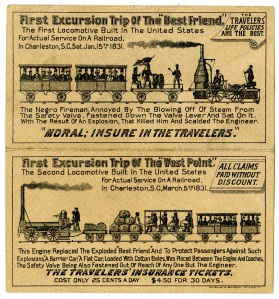

First Excursion Trip Of The “Best Friend”

The First Locomotive Built In The United States

For Actual Service On A Railroad,

In Charleston, S.C. Sat. Jan, 15th 1831.

The Travelers Life Policies Are The Best.

The Negro Fireman, Annoyed By The Blowing Off Of Steam From

The Safety Valve, Fastened Down The Valve Lever And Sat On It,

With The Result Of An Explosion, That Killed Him And Scalded The Engineer.

“Moral; Insure In The Travelers.”

BOTTOM

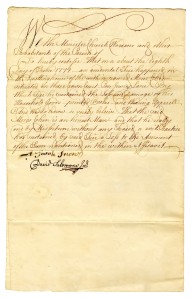

First Excursion Trip Of The “West Point”

The Second Locomotive Built In the United States

For Actual Service On A Railroad,

In Charleston, S.C. Sat. March, 5th 1831.

All Claims Paid Without Discount.

This Engine Replaced The Exploded “Best Friend” And To Protect Passengers Against Such Explosions, A “Barrier Car,” A Flat Car, Loaded With Cotton Bales, Was Placed Between The Engines And Coaches, The Safety Valve Also Being Fastened Out Of Reach Of Anyone But The Engineer.

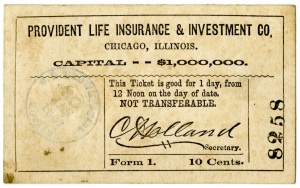

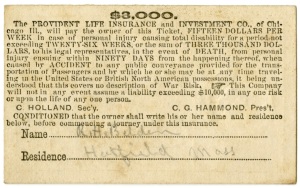

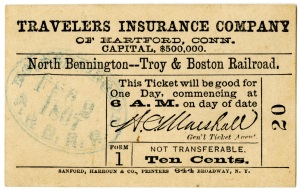

The Travelers’ Insurance Tickets

Cost Only 25 Cents A Day $4.50 For 30 Days.